Evergrande Default Risk

Evergrande default risk are a topic that has been searched for and liked by netizens today. B rating means material default risk is present but a limited margin of safety remains.

China Evergrande S Rising Default Risks Shift Focus To Possible Beijing Rescue Euronews

Investors are getting increasingly jittery amid mounting fears of a messy collapse.

Evergrande default risk

. The risk of a US debt default is being overlooked by Chinas deflating property market. But whether a missed payment on the part of subsidiaries would directly constitute a default at the Evergrande level would depend on whether there is a guarantee relationship. All you need to know. The crisis facing the Chinese property giant has materialized as the company has failed to pay coupons to its investors that were due yesterday.Size Of Potential Default. Dont overthink this. BTC is sovereign credit insurance long volatility with no counterparty risk. Evergrande is an enormous and heavily indebted private-sector Chinese property developer and home builder that is close to defaulting on some of its billions of dollars in.

Evergrandes rising default risk. Evergrande Default October. IE this defaulting could be a bit of a Lehman-esque type moment. Evergrandes project companies which are subsidiaries might have interest payments on banks loans due before Sept.

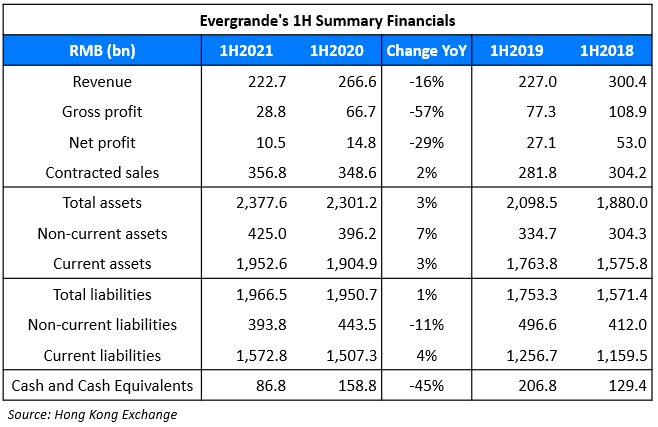

China Evergrande the countrys indebted real estate giant avoided a formal default yet again after a bondholder said. Total liabilities at Evergrande are 300 billion of which 200 billion is pre-payments for housing from Chinese. Evergrande is heading for default. Yesterday it was due to repay 835m in interest accrued on offshore bonds.

Evergrande default risk Ft Evergrande Liquidity Crisis Why The Property Developer Faces Risk Of. Explains why Evergrande is a big risk for Chinas entire housing market and broader economy. Evergrande has debts of more than 300bn 2 of Chinas GDP. A default or series of defaults could spread panic in credit markets.

Chinas property sector has come under the spotlight since the debt problems of Evergrande surfaced. That could be just the beginning the fearful thinking goes. Evergrande represents potential systemic risk both in China as well as the global financial markets. A default is likely.

Shares in ailing Chinese developer Evergrande plummeted on Monday September 20. World markets have been watching for days how Evergrandes situation unfolds after the company announced it was at risk of defaulting on around 400 billion worth of loans. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of. Evergrande will default on both the bonds if its fails to settle the interest within 30 days of the payments becoming due.

1 day agoEvergrande News. Chinas Evergrande default risks spook global markets Global stocks sank on Monday amid fears that a possible collapse of beleaguered. Hong Kong CNN Business For the second time this month Chinas most indebted developer Evergrande has reportedly managed to avoid default at. File photo NEW.

Why the property developer faces risk of default Chinas most indebted real estate company struggles to escape vicious cycle as cash crunch mounts. Evergrande shares plummet as default risk mounts. TOKYO As distracting as the default drama looming over China Evergrande Group may be the one percolating in Washington is by far the more existential of the two. You can Get or bookmark the Evergrande default risk files here.

20 hours agoChinas Evergrande avoids default for 3rd time in a month with last minute cash scramble. 1 day agoCash-strapped developer China Evergrande Group once again averted a destabilising default with a last minute bond payment but the reprieve did little to alleviate strains in the countrys wider. Evergrande has debts of more than 300bn 2 of Chinas GDP. Default alarms put thousands of suppliers jobs and economy at risk as developers IOUs balloon.

After all Evergrandes total pile of debt comes to 300 billion. Default alarms put thousands of suppliers jobs and economy at risk as developers IOUs balloon. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of. Evergrande is weighed down by 305 billion in liabilities.

With that out of the way I want to be very clear - this is NOT likely to default since the strong likelihood is that it will get a bailout due to the system wide risk. Chinese troubled property giant avoids another default. In the context of recent meaningful global defaults the Evergrande debt is not overly concerning. Evergrande default risk Your Evergrande default risk pictures are ready in this website.

Evergrande is heading for default. China debt crunch Embattled Evergrande reveals attempted EV stake sale to Xiaomi. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of. The stock closed down by around 10 hitting 11-year lows.

US default a greater risk than Evergrande meltdown.

Embattled China Evergrande Warns Of Cross Default Liquidity Crunch Euronews

Evergrande Default Risk Draws Attention To Potential Beijing Bailout California18

China Evergrande Warns Of Default Risk If It Fails To Sell Assets Nikkei Asia

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

China S Evergrande Group Warns Of Cross Default Risk

Evergrande At Risk Of Default Prepare For The Worst The Cryptonomist

China Evergrande Warns Of Default Risk Rising Litigation Cases

Post a Comment for "Evergrande Default Risk"